The Complete Guide to SaaS Pricing Strategy

Tom Tunguz

FEBRUARY 26, 2025

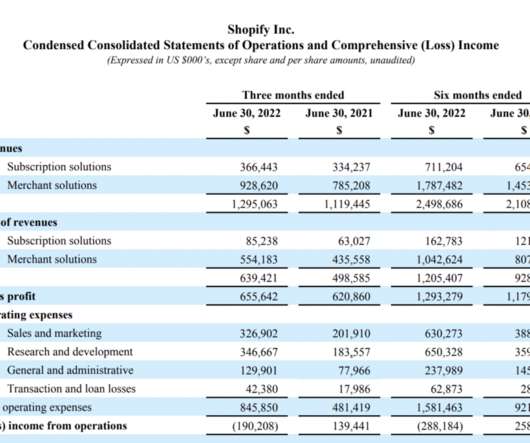

But throughout this turmoil, startups must adopt a process to craft a good pricing strategy, and re-evaluate prices periodically, at least once per year. They prioritize revenue growth, market share and profit maximization differently. Maximization (Revenue Growth) - maximize revenue growth in the short term.

Let's personalize your content