What is a Payment Processing System and How Does It Work?

Stax

MARCH 18, 2025

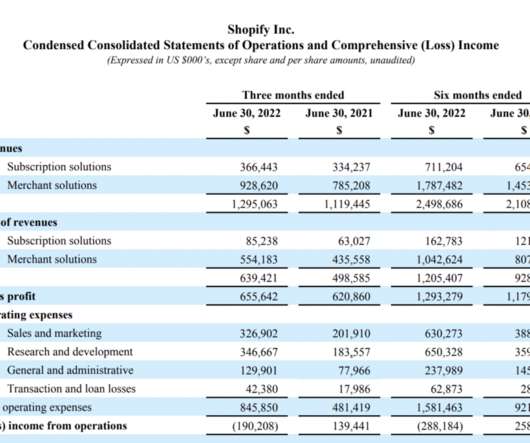

According to the US Federal Reserve in 2022, general-purpose card payments reached $153.3 On top of that, 69% of Americans online in 2023 said they used digital payment methods to make a purchase. To address evolving customer demands and accept electronic payments, you need a payment processing system.

Let's personalize your content