Payment Security: Everything You Need to Know About Secure Payments

Stax

MARCH 4, 2024

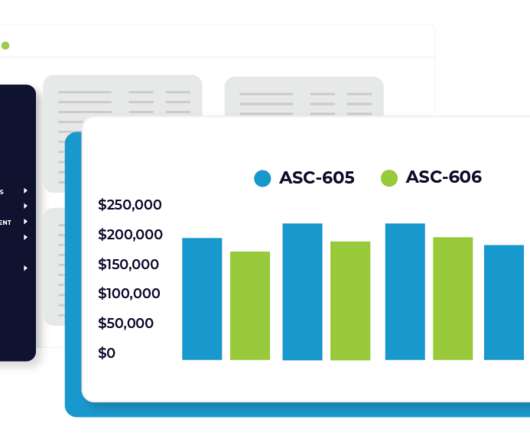

Stax delivers an all-in-one payments platform that is secure, stable and customizable—and did we mention affordable? Innovations in artificial intelligence (AI) and machine learning are helping develop security solutions faster than ever. At Stax, we help businesses keep up with all things payment security.

Let's personalize your content