Quicken vs QuickBooks: Which is Best for Small Businesses?

Stax

OCTOBER 13, 2024

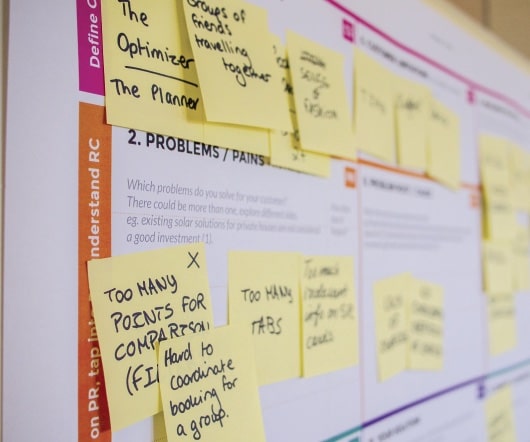

Users can view banking information, track monthly bills, track investments, manage credit card accounts, and much more. Learn More Stax offers the lowest cost of accepting credit cards among all merchant account providers. The two platforms are aimed at different audiences. Quicken Inc.

Let's personalize your content