The Ultimate Guide to Ecommerce Payment Solutions

Stax

APRIL 3, 2025

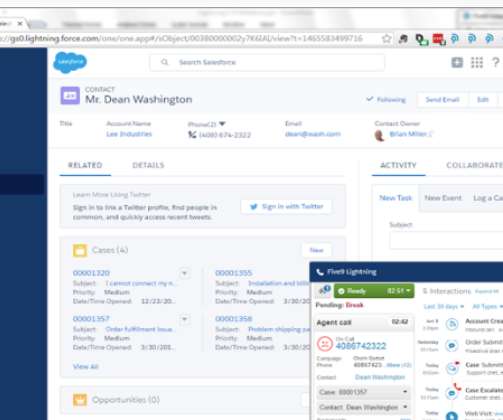

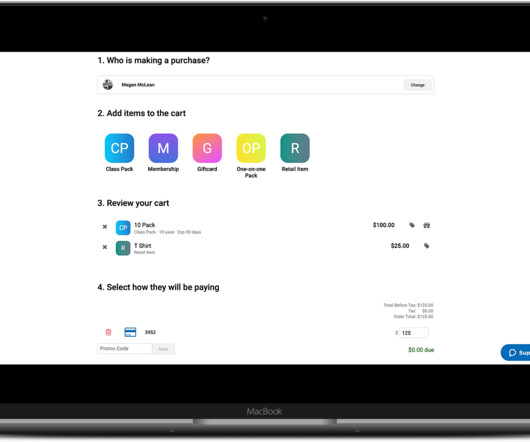

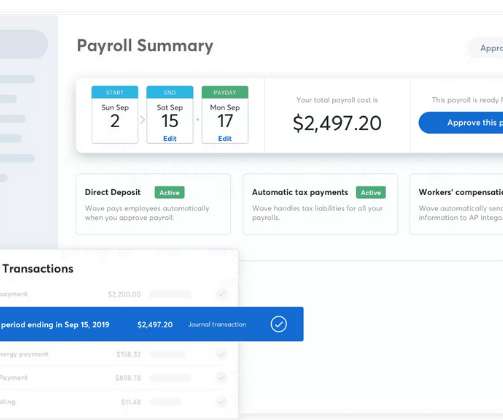

But launching your eCommerce store is just half the equationaccepting payments efficiently and effectively is a whole different ball game. On the surface, it seems effortless, with customers only taking a few seconds to initiate and complete payments. The eCommerce payment solution infrastructure involves several key players.

Let's personalize your content