Everything You Need To Know about Merchant Processing and How To Choose the Right Solution for Your Needs

Stax

APRIL 30, 2024

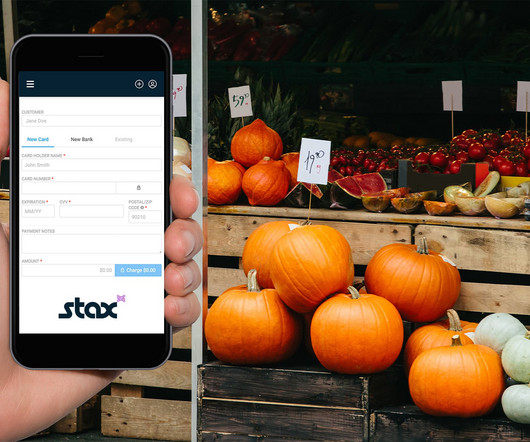

If the details are verified and there are enough funds in the customer’s account, the issuing bank will send an authorization code to the card company through the payment processor. This authorization code is forwarded to the card company and then to the acquiring bank. Easy switch between POS and mobile payments using the Stax app.

Let's personalize your content