Need a Digital River Replacement ASAP? FastSpring Can Help

FastSpring

JANUARY 28, 2025

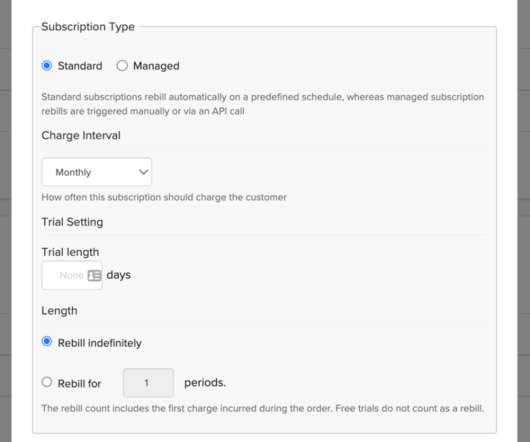

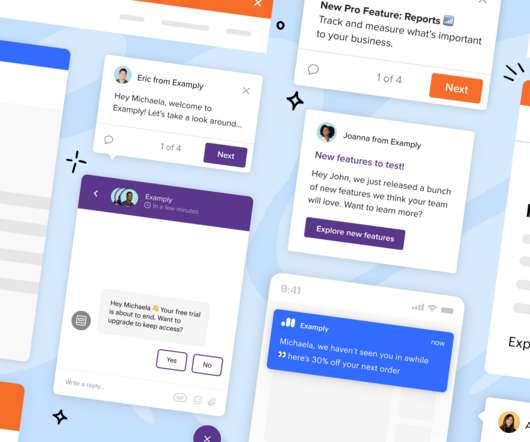

Are you a Digital River customer in emergency need of a new payment and subscription provider ASAP? FastSpring has already helped many Digital River customers make the switch , and if youre looking for a new merchant of record to help your digital business with payments and subscriptions, were here to help you, too.

Let's personalize your content