Payment processor: Definition, types, and examples

Payrix

FEBRUARY 4, 2025

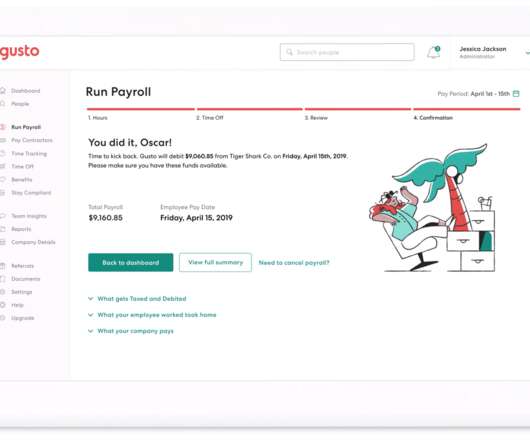

What is a payment processor? A payment processor facilitates the flow of transactions typically made with credit cards, debit cards, and other digital payments. But at the most basic level, this is how the payment processor is involved in a credit card transaction: 1.

Let's personalize your content