Going Global: Why a Localized Checkout Is Key to SaaS Success

FastSpring

NOVEMBER 27, 2024

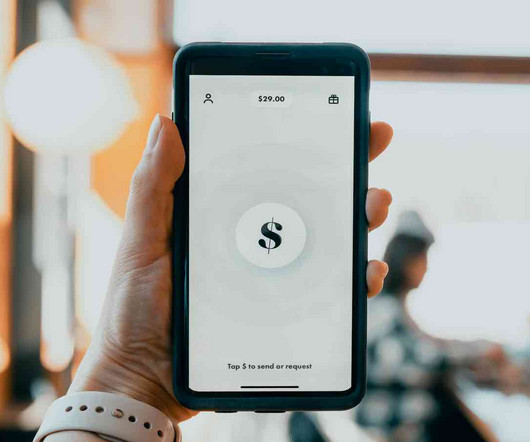

In the SaaS industry, the checkout experience can make or break a sale. A seamless, localized checkout process is crucial for converting potential customers, especially in global markets. Focusing on these three key areas can help your SaaS business win more customers: Language. Payment methods. Currency display.

Let's personalize your content