The Rise of Vertical SaaS: Achieving 110% NRR from SMBs with Mangomint’s CEO

SaaStr

NOVEMBER 27, 2024

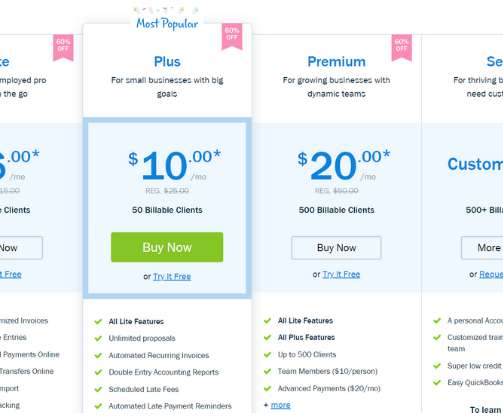

Its product provides software to spas and salons but it’s not new (the first salon software came out in the 80s), and neither is a lot of the vertical software getting hot today. 10-15 years ago, salon and spa software was essentially a calendar with bells and whistles. readily available that didn’t exist before.

Let's personalize your content