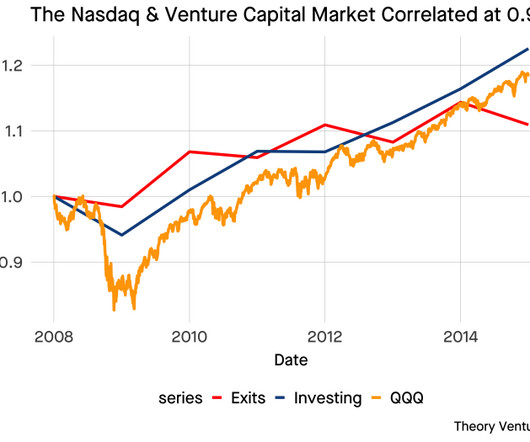

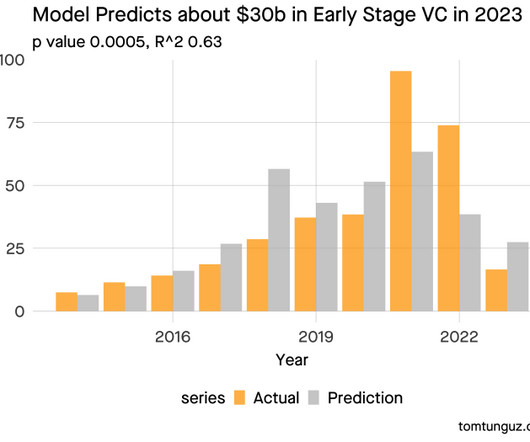

Passive Investing in Venture Capital and the Parallels to Public Equities

Tom Tunguz

OCTOBER 7, 2021

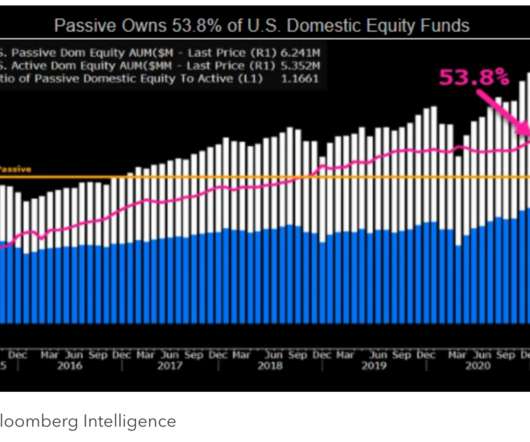

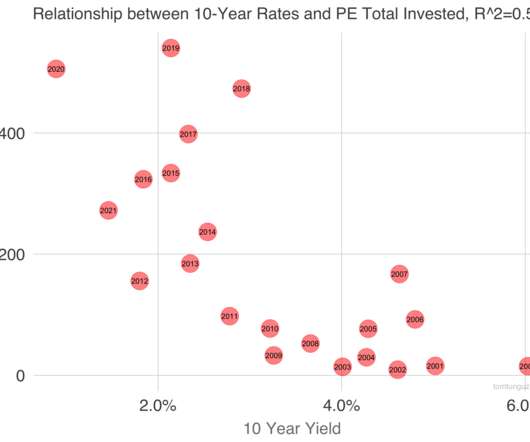

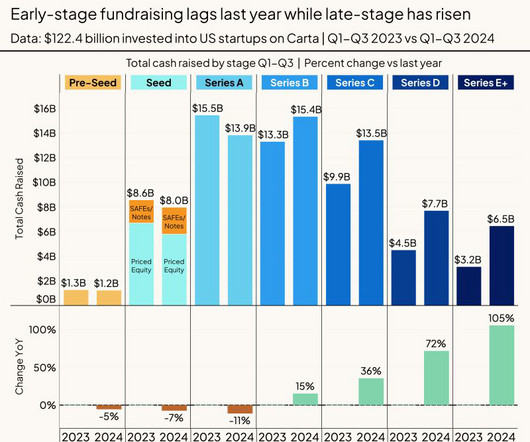

Passive venture capital investing is a relatively new idea. As later stage investors permeate venture capital, they are amassing index funds of startups. Classically, venture capital has been an active asset class. There isn’t a one-to-one mapping of growth capital and passive venture capital.

Let's personalize your content